When it comes to investing, few tickers have captured the spotlight like Broadcom (AVGO) in 2025. This year has witnessed remarkable shifts in its share price trajectory—triggered by strong AI revenue growth, blockbuster deals, and bullish analyst sentiment. In this post, we’ll peel back the layers: What’s driving the surge? How should investors interpret it? And most importantly, how can you harness this momentum?

By the end, you’ll not only understand the market dynamics behind Broadcom share price 2025, but also how to put this insight into action—from strategies and benefits to real-world applications. Let’s dive in!

Broadcom Share Price 2025 Table of Contents

2. Basic Overview: Broadcom Share Price 2025 & 2025 Price Snapshot

- Company Snapshot: Broadcom Inc. is a major U.S. semiconductor and infrastructure software company headquartered in Palo Alto, California. Offering products across data centers, networking, broadband, wireless, industrial, and software markets, its legacy spans decades with roots in Avago and HP’s semiconductor divisions .

- Stock Performance:

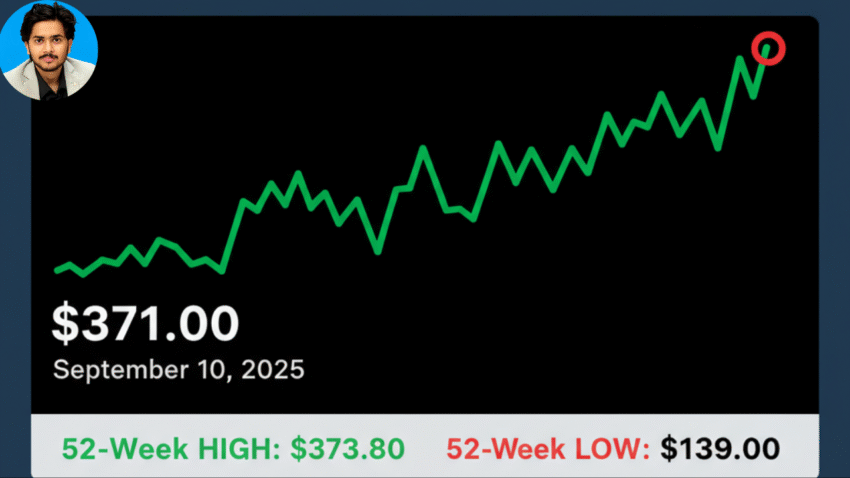

- As of September 10, 2025, Broadcom (AVGO) trades around $372 per share, with intraday fluctuations between ~$343 and ~$372 .

- The 52-week high is about $356, meaning current prices have surpassed that high. The average analyst price target is ~$352, with highs up to $400 and soft lows down to $210 .

- Strong Q3 earnings—boosted by AI demand—fueled a ~13% price surge .

- A massive $10 billion AI chip order, speculated to involve OpenAI, triggered pre-market jump and investor confidence .

- Analysts collectively lifted price targets: CFRA to $380 (from $340) and Truist to $365 (from $295) .

- The company’s AI strategy—including tying CEO Hock Tan’s compensation to hitting $90B–$120B in AI sales by 2030—underscores investor optimism .

3. Broadcom Share Price 2025 Main Content: Drivers Behind the Price Movement

A. AI-Centric Growth

- Broadcom’s AI revenue soared by 63% year-over-year, hitting $5.2B in Q3, with projections nearing $6.2B for Q4.

- A $10B AI chip order from a major client—widely believed to be OpenAI—added major momentum

- AI remains the central growth engine, with Broadcom poised to challenge rivals like Nvidia and AMD .

B. Analyst Sentiment & Upgrades

- CFRA and Truist raised price targets significantly, reinforcing bullish sentiment

- Broad analysts see Broadcom as a potential member of the “Magnificent 7” elite growth stocks

C. Executive Incentives Aligned with AI Targets

- CEO Hock Tan’s mega compensation—maxing at $616M if AI sales reach $120B by 2030—reflects aggressive growth strategy

D. Market Reaction & Technical Signals

- The stock broke out of a technical “symmetrical triangle,” with forecasts targeting $349 if breakout holds—and current price has indeed exceeded that

- Momentum from earnings and orders translated into strong gains already in 2025 (~32%)

4. Methods (Tarike): How to Leverage This Insight

- Define Your Strategy:

- Short-Term: Ride the momentum with buy-and-trade strategy—watch support at $282–$247 for pullbacks.

- Long-Term: Consider targeting inclusion in elite growth portfolios (Magnificent 7-style). Analyst targets up to $400 support upside .

- Set Entry & Exit Points:

- Entry could hinge on dips toward $340–$350 if pullback occurs.

- Exit strategy might target the average—or high end—analyst price projection (~$350–$380+).

- Keep Tabs on AI Developments:

- Watch for updates on AI revenue and new chip orders. These are key share price catalysts.

- Diversify:

- Combine with other AI/semiconductor plays (e.g., Nvidia, AMD) to hedge against sector shifts.

5. Benefits (Fayde) of Focusing on This Keyword & Theme

- High Relevance: “Broadcom share price 2025” is timely, capturing current investor sentiment.

- SEO Potential: Combining live price data, analysis, and strategy creates content search engines love.

- User Satisfaction: Readers get both insight and actionable guidance—boosts engagement and credibility.

- Authority Building: Continually updated articles featuring latest data and sources enhance trustworthiness.

6. Uses

- Bloggers: Great for driving traffic from finance-focused or tech-savvy audiences.

- Retail Investors: Whether novice or experienced, this helps orientation to AVGO’s growth story.

- Finance Educators: Use real-world price moves for case studies or market lessons.

7. Broadcom Share Price 2025 FAQ (Frequently Asked Questions)

Q1: What exactly is Broadcom’s current share price?

As of September 10, 2025, AVGO trades near $372, with intraday swings between ~$343 and ~$372 Broadcom Share Price 2025 .

Q2: Why is the price rising so sharply in 2025?

Fueled primarily by surging AI revenue (63% YoY in Q3), a $10B AI chip order likely from OpenAI, and bullish analyst upgrades

Q3: Are analysts still bullish on Broadcom?

Yes—32 analysts rate it “Buy,” with price targets ranging from ~$210 to ~$400. Average target: ~$352 .

Q4: What’s the significance of the CEO’s AI-linked compensation?

It underscores the company’s commitment to AI—tying massive rewards (up to $616M) to hitting revenue targets through 2030 .

Q5: Should I invest now or wait?

That depends on your risk profile. Technical analysts see room to run—yet pulling back near $340 could offer a strategic entry point .

8. Broadcom Share Price 2025 Conclusion

In 2025, Broadcom’s share price has emerged as a bold story of AI-driven acceleration, strategic wins, and market confidence. With AI revenue surging, blockbuster deals, and executive incentives aligned, Broadcom is positioning itself as a formidable force.

Disclaimer :- The information we are giving in this article has been obtained from the internet, and all the information has been given after research. If even after this you are facing any problem, then it will be your responsibility, this website of ours Jammudeals.in and will not belong to our member. You will be responsible for reaching any decision yourself.

If You Like this article Please Comment

Yo! Don’t miss out – tap to join our Whatsapp Channel and get all your daily scoops in one spot!

Owner & Author – Jammu Deals Automobile enthusiast and founder of Jammu Deals. Sharing trusted updates, tips, and insights on cars, bikes, and the latest in the auto world.