Finance Minister Nirmala Sitharaman unveiled the inaugural budget for the Modi 3.0 initiative, revealing the introduction of new income tax slabs designed to offer tax relief to individuals.

This announcement, set to affect numerous taxpayers, sees the government increasing the threshold for the standard deduction under the updated tax structure from Rs 30,000 to Rs 75,000. Consequently, this adjustment is anticipated to lead to significant savings for those eligible, with the objective of enhancing disposable income and encouraging consumer expenditure.

Table of Contents

What is the new tax regime for middle class?

The applicable tax rate for income exceeding Rs 15 lakh should be reduced to a range of 22-25%. Additionally, it may be prudent to introduce a new tax bracket, elevating the tax rate to a maximum of 30% for income levels exceeding Rs 25 lakh.

Planning to sell old property? Govt wants you to pay more tax

FM Sitharaman surprised many when she announced the removal of the indexation benefit for capital gains tax on property sales as well as hike in long-term capital gains tax.

With rationalisation of rate to 12.5%, indexation available under second proviso to section 48 is proposed to be removed for calculation of any long-term capital gains which is presently available for property, says CA Dr. Suresh Surana.

How does the government earn?

Around 27% of every rupee earned by the government comes from borrowing and other liabilities, while 19% comes from Income tax.

What is the new income tax regime?

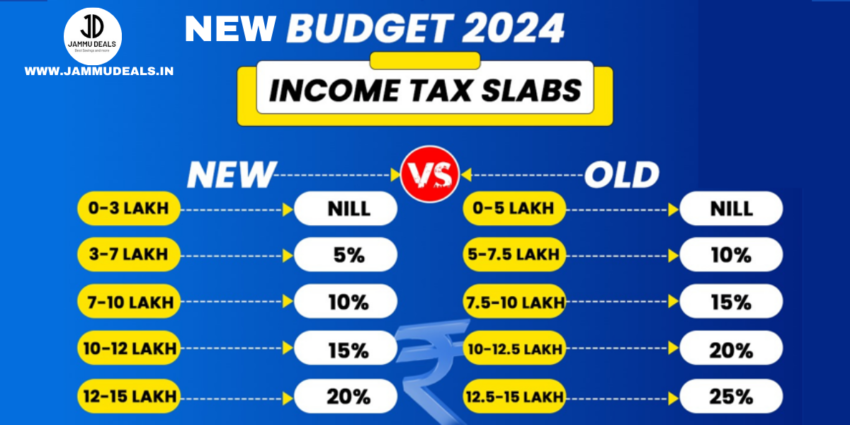

Finance Minister Nirmala Sitharaman has effected some changes to tax slabs under the new tax regime. Now, taxpayers earning up to Rs 3 lakh will pay NIL tax. On Rs 3 lakh to Rs 7 lakh income, 5% income tax would be imposed and Rs 7 lakh to Rs 10 lakh income would attract 10% tax. Those earning Rs 10 lakh to Rs 12 lakh would pay 15% tax and those with an annual income of Rs 12 lakh to Rs 15 lakh would shell out 20% tax. 30% tax will be levied on income above Rs 30%.

With this tax rate, an individual earning up to Rs 10 lakh will save Rs 10,000 in taxes if he opts for new tax regime. Earlier, the same income was attracting a tax of Rs 57,500 against Rs 47,500 now.

What are the changes in the budget in 2024?

“The Union Budget 2024 brings substantial changes to personal finance that will benefit a large number of taxpayers. The increase in the standard deduction from Rs 50,000 to Rs 75,000 and the revision of the tax slab limit for the 5% tax rate from Rs 5 lakh to Rs 7 lakh will significantly enhance disposable income. These changes will provide much-needed financial relief to the middle class and boost overall consumption.

Furthermore, the proposal to increase the deduction of employer expenditure towards NPS from 10% to 14% of the employee’s salary will improve social security benefits for the workforce. The revamp of the capital gains tax regime will impact investment decisions and financial planning, ensuring a more balanced and fair approach to taxation. These measures collectively contribute to a more robust and financially secure environment for individuals and families across India,” says Rohan Bhargava, Co-Founder of CashKaro

What are the rebates allowed in the new tax regime?

Rebate Limit Under Section 87A for All the Financial Years

| Financial Year | Limit on total taxable Income | Amount of rebate allowed u/s 87A |

|---|---|---|

| 2023-24 | Rs. 7,00,000 (under New tax regime) | Rs. 25,000 |

| 2023-24 | Rs. 5,00,000 (under Old tax regime) | Rs.12,500 |

| 2022-23 | Rs. 5,00,000 | Rs. 12,500 |

| 2021-22 | Rs. 5,00,000 | Rs. 12,500 |

What is the difference between the old and new tax regime?

Taxpayer earns ₹10 lakh: Under the old tax regime, the tax liability is ₹1,12,500. After deducting 87A rebate, it is 1,00,000. Under the new tax regime, the tax liability is ₹50,000 (5 per cent of 4,00,000 + 10 per cent of 3,00,000). After reducing 87A rebate of ₹25,000, the tax liability is ₹25,000.

So, in both scenarios, the tax liability is ‘zero’.

| Income | Old tax regime (Rs) | New tax regime (Rs) | Saving (Rs) |

| 5 lakh | 0 | 0 | N/A |

| 10 lakh | 1,00,000 | 25,000 | 75,000 |

| 15 lakh | 2,50,000 | 1,40,000 | 1,35,000 |

What is the New Budget for 2024?

Budget Estimates 2024-25

New Budget 2024 Key Highlights Live: Here are the Budget Estimates 2024-25:

- FY25 Total Receipts estimated at ₹32.07 lakh crore

- FY25 Total Expenditure estimated at ₹48.21 lakh crore

- Net tax receipts estimated at ₹25.83 lakh crore

- Gross market borrowings estimated at ₹14.01 lakh crore

- Net market borrowings estimated at ₹11.63 lakh crore

- FY25 Fiscal deficit estimated at 4.9% of GDP

The fiscal consolidation path announced by me in 2021 has served our economy very well, and we aim to reach a deficit below 4.5% next year. The Government is committed to staying the course. From 2026-27 onwards, our endeavour will be to keep the fiscal deficit each year such that the Central Government debt will be on a declining path as percentage of GDP, Finance Minister Nirmala Sitharaman said.

Is there an 50,000 standard deduction in the new tax regime?

Finance Minister Nirmala Sitharaman has announced a hike in standard deduction from the current Rs 50,000 to Rs 75,000 under the new income tax regime.

What are the deductions under the new tax regime?

The standard deduction limit has been increased from Rs 50,000 to Rs 75,000, and the tax slabs have been revised. These changes aim to provide substantial savings for salaried employees, who can now save up to Rs 17,500 in income tax annually.

Read Also :- Oppo K12x 5G India Launch On July 29: Features, Specs, More

What is the new tax slab in 2024?

Income Tax Budget 2024 LIVE Updates: FM proposes new income tax slabs. FM proposes new income tax slabs – up to ₹3 lakh nil, ₹3-7L 5%, ₹7-10L 10%, ₹10-12L 15%, ₹12-15L 20%, above ₹15L 30%

Comparison of pre-budget and post-budget tax slab

| Tax Slab for FY 2023-24 | Tax Rate | Tax Slab for FY 2024-25 | Tax Rate |

| Upto ₹ 3 lakh | Nil | Upto ₹ 3 lakh | Nil |

| ₹ 3 lakh – ₹ 6 lakh | 5% | ₹ 3 lakh – ₹ 7 lakh | 5% |

| ₹ 6 lakh – ₹ 9 lakh | 10% | ₹ 7 lakh – ₹ 10 lakh | 10% |

| ₹ 9 lakh – ₹ 12 lakh | 15% | ₹ 10 lakh – ₹ 12 lakh | 15% |

| ₹ 12 lakh – ₹ 15 lakh | 20% | ₹ 12 lakh – ₹ 15 lakh | 20% |

| More than 15 lakh | 30% | More than 15 lakh | 30% |

Disclaimer :- The information we are giving in this article has been obtained from the internet, and all the information has been given after research. If even after this you are facing any problem, then it will be your responsibility, this website of ours Jammudeals.in and will not belong to our member. You will be responsible for reaching any decision yourself.

If You Like this article Please Comment

Yo! Don’t miss out – tap to join our Whatsapp Channel 📲 and get all your daily scoops in one spot!

Owner & Author – Jammu Deals Automobile enthusiast and founder of Jammu Deals. Sharing trusted updates, tips, and insights on cars, bikes, and the latest in the auto world.